Harare, Zimbabwe: An International Monetary Fund (IMF) staff team led by Mr. Wojciech Maliszewski visited Harare from June 4 to June 18, 2025, to conduct the 2025 Article IV Consultation.

Harare, Zimbabwe: An International Monetary Fund (IMF) staff team led by Mr. Wojciech Maliszewski visited Harare from June 4 to June 18, 2025, to conduct the 2025 Article IV Consultation.

At the conclusion of the IMF mission, Mr. Maliszewski issued the following statement:

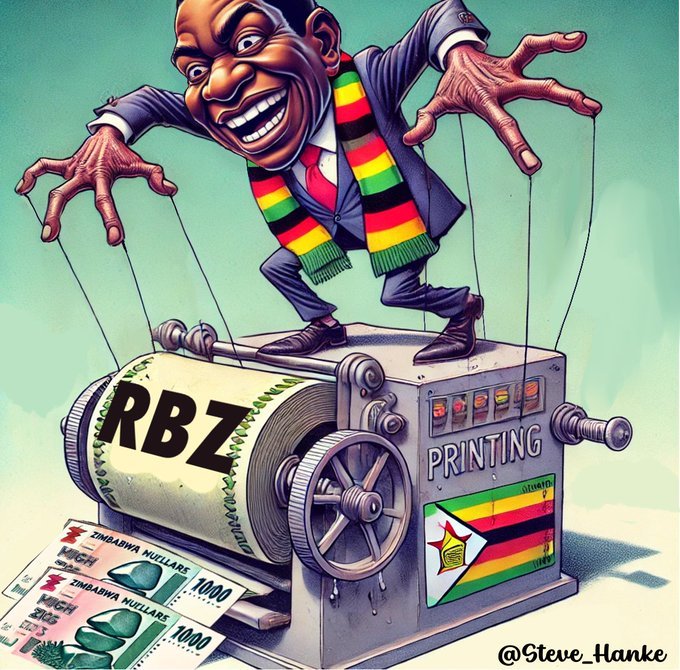

“Zimbabwe is experiencing a degree of macroeconomic stability despite lingering policy challenges. Following successive bouts of hyperinflation over the past few years, more disciplined policies—including halting and transferring to the Treasury the quasi-fiscal operations (QFOs) of the Reserve Bank of Zimbabwe (RBZ) and tighter monetary policy despite fiscal pressures—have helped stabilize the local currency (the ‘ZiG’) and reduce inflation. Growth this year is recovering following a sharp slowdown in 2024, which was affected by a drought that lowered agricultural output by 15 percent. Electricity production also fell, and declining prices for platinum and lithium weighed on the mining output. During the first half of 2025, better climate conditions and historically high gold prices have boosted agricultural and mining activity, strengthening the current account and contributing to the recovery, with growth projected at 6 percent in 2025."

Well we will leave his tangled and politcally acceptable verbage and recruit AI [Artificial Intelligence] to put this into readable, bullet point ENGLISH! No offence Mr Maliszweski - but free-thinking Zimbabwean's at home and the diaspora what the truth in plain speak!

AI Analysis of entire Statmemt converted into Bullet points - each referenced with a supporting web link!

Here’s a straightforward breakdown of the International Monetary Fund’s (IMF) 2025 Article IV Mission findings for Zimbabwe, explained in plain language for the average person:-

*Economy Growing, but Challenges Remain*:

Zimbabwe’s economy is expected to grow by 6% in 2025, thanks to better weather helping farming and high gold prices boosting mining. However, inflation (rising prices) is a worry, projected to hit 15% by year-end due to issues with the local currency, ZiG.[](/www.imf.org/)-

*ZiG Currency Needs More Trust*:

The IMF wants Zimbabwe’s gold-backed ZiG to become the main currency, but many people and businesses still prefer using U.S. dollars because they don’t fully trust ZiG. The government needs to make ZiG more reliable and widely accepted.[](Nehandaradio.com)[](zimpricecheck.com)-

*Government Spending and Debt Issues*:

The government is collecting more taxes, which is good, but it’s still spending too much and building up unpaid bills (arrears). This could cause problems if not controlled. The country’s huge debt (over $21 billion) also blocks access to IMF loans until it’s restructured.[](newzimbabwe.com)[](imf.org)-

*Corruption and Governance Need Fixing*:

The IMF says Zimbabwe must tackle corruption and improve how the economy is managed to keep growing and reduce poverty. This includes making business easier and stopping illegal activities like smuggling.[](allafrica.com[](african.business)-

*Progress on Reforms, but More Needed*:

Zimbabwe is making some positive changes, like stabilizing the ZiG and deepening the foreign exchange market. However, the IMF urges “decisive steps” to lock in these gains, like tighter control over money supply and clearing debt arrears.[](news.pindula.co.zw)[](theeastafrican.co.ke)[](x.com/newswireZW)-

*No IMF Cash Yet*:

Zimbabwe can’t get financial help from the IMF until it clears its debts and shows a solid plan for managing the economy. A Staff-Monitored Program (SMP) is being discussed to help guide reforms, but it doesn’t provide money.[](imf.org)[](imf.org/zimbabwe-imf-completes-smp-discussion-mission

In short, Zimbabwe’s economy is improving, but trust in the currency, government spending, corruption, and debt are big hurdles. The IMF sees potential but wants stronger action to ensure lasting progress.

Continued IMF verbage - for all of it check the web link above or [HERE - IMF FULL REPORT on Zimbabwe]

Continued IMF verbage - for all of it check the web link above or [HERE - IMF FULL REPORT on Zimbabwe]

“Buoyed by the growth recovery and policy measures—a reduction in VAT tax reliefs, increased fees and levies, taxation of the COVID public servant allowance, and steps to reduce smuggling—revenue ratio increased sharply to 18 percent of GDP. That said, fiscal pressures intensified in 2024 and in the first months of 2025 as higher revenues proved insufficient to meet growing spending needs. These came notably from higher public sector wages, capital outlays related to a SADC summit, debt servicing costs on past QFOs by the RBZ taken over by the Treasury, and servicing liabilities related to the acquisition of assets for the Mutapa Investment Fund. The fiscal deficit was financed by T-bills issuance and direct borrowing from the RBZ’s overdraft facility to service debt, contributing to the expansion of domestic liquidity and an overnight drop in the value of the ZiG in September 2024, and a significant buildup of expenditure arrears that continued into 2025.

“Following the overnight drop in the value of the ZiG, inflation spiked in October 2024 then declined significantly as both the willing-buyer willing-seller (WBWS) and parallel market rates have since stabilized, helping to bring month-on-month inflation down to an average of 0.5 percent over the period February to May 2025. At the same time, the gap between the WBWS and parallel market rates has narrowed significantly, but remains at around 20 percent. In this context, the mission welcomed the repeal of Statutory Instrument 81A of 2024—which had mandated the formal sector to use the WBWS rate in the pricing of goods and services, contributing to an increase in dollarization and informality.

“To support the authorities’ stabilization efforts, key Article IV recommendations include: in the near term, fiscal policy actions to center on closing the financing gap without recourse to monetary financing and further domestic arrears buildup, while safeguarding social spending, and delivering a durable fiscal adjustment in the longer term; monetary and FX policy to focus on supporting a transition to stable national currency, with an effective monetary policy framework and market-determined exchange rate policy; and, to boost growth, structural and economic governance reforms. In this context, policy priorities include: